Why pay more?

Drive for less with us.

With Novated Choice, you can lease your next car using pre-tax income, pay no GST, and enjoy more money in your pocket every payday.

It’s the smarter way to drive your next car.

Drive Smarter, Save More!

Give Yourself a Free Pay Rise!

A novated lease offers significant savings and flexibility, making it an ideal choice for many. Compare the total out-of-pocket costs for a novated lease, a standard car loan, and an upfront cash purchase. This breakdown illustrates why a novated lease often delivers the lowest overall cost.

Novated Choice

Best value

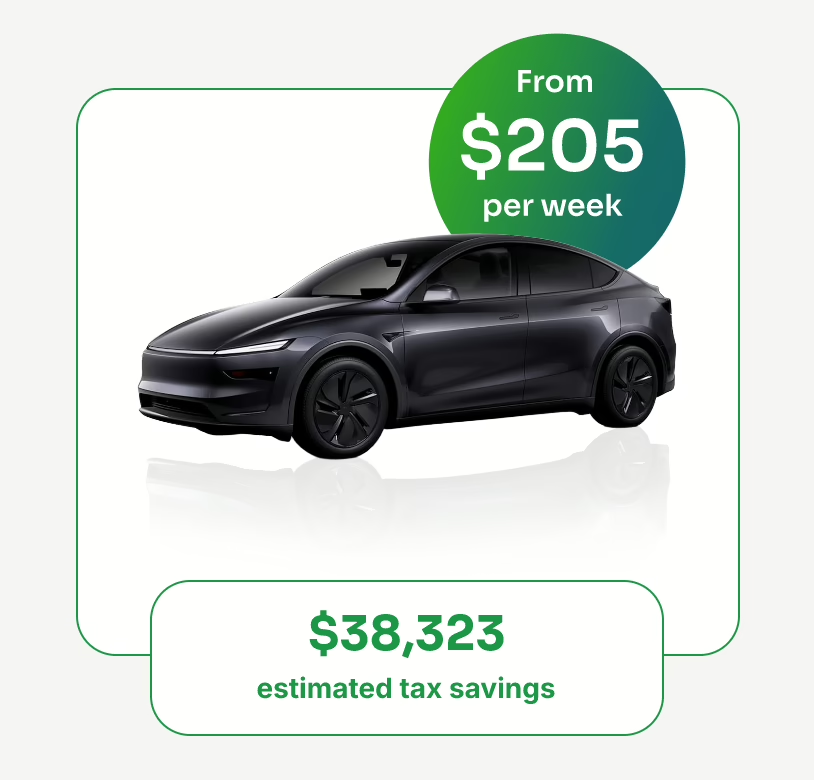

$205 per week

Outright

$320 per week

Financed Loan

$380 per week

*Terms and conditions apply

Your Novated Lease Questions, Answered

We have a panel of lenders from which we select the best one to suit your financial circumstances. Our national buying program gives us buying power to save you money, and we can often provide significant savings on the recommended retail price.

During the lease, the finance company owns the car, but you have full use of it without any upfront costs. At the end of the term, you can choose to buy it, upgrade to a new model, extend the lease, or walk away–it’s your choice.

You choose: When your lease ends, choose to pay the residual to own or sell, extend your lease if eligible, or upgrade.